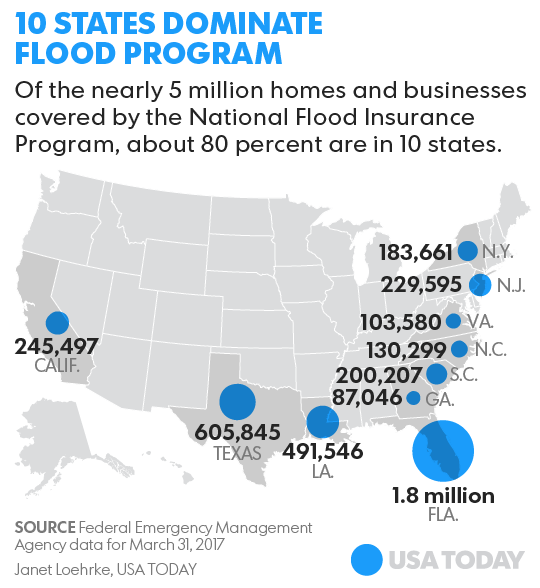

Local governments pass and enforce regulations for designated SFHAs.Ĭontact local floodplain administrators for more information on specific local requirements.įor mitigation information visit /Louisiana-Disaster-Mitigation. Find an agent in your area by calling 80 to reach the NFIP call center.You can only purchase flood insurance through an insurance agent you cannot buy it directly from the NFIP. To find out if your community participates in NFIP call 80.More than 315 Louisiana communities participate in NFIP.In order to qualify for flood insurance, the home or business must be in a community that has joined the NFIP and agreed to enforce sound floodplain management standards. Costs vary depending on how much insurance is purchased, what it covers and the property's flood risk.NFIP is administered by FEMA, which works closely with more than 80 private insurance companies to offer flood insurance to homeowners, renters, and business owners.įlood insurance is available to homeowners, renters, condo owners/renters, and commercial owners/renters. Flood insurance rates reflect the uncertainty of the flood risk. The average flood insurance cost Houston homeowners will pay is 615 per year on their flood insurance coverage.These areas are shown on flood maps or areas beginning with the letter 'D.

Some flood maps also include areas where there are possible but undetermined flood hazards or unstudied areas.

There is at least a 1 in 4 chance of flooding during a 30-year mortgage in high-risk areas.Īll home and business owners in high-risk areas with mortgages from federally regulated or insured lenders are required to buy flood insurance.They are shown on the flood maps as zones beginning with the letters 'A' or 'V.'.Special Flood Hazard Areas are high-risk areas.

#Flood insurance cost texas free#

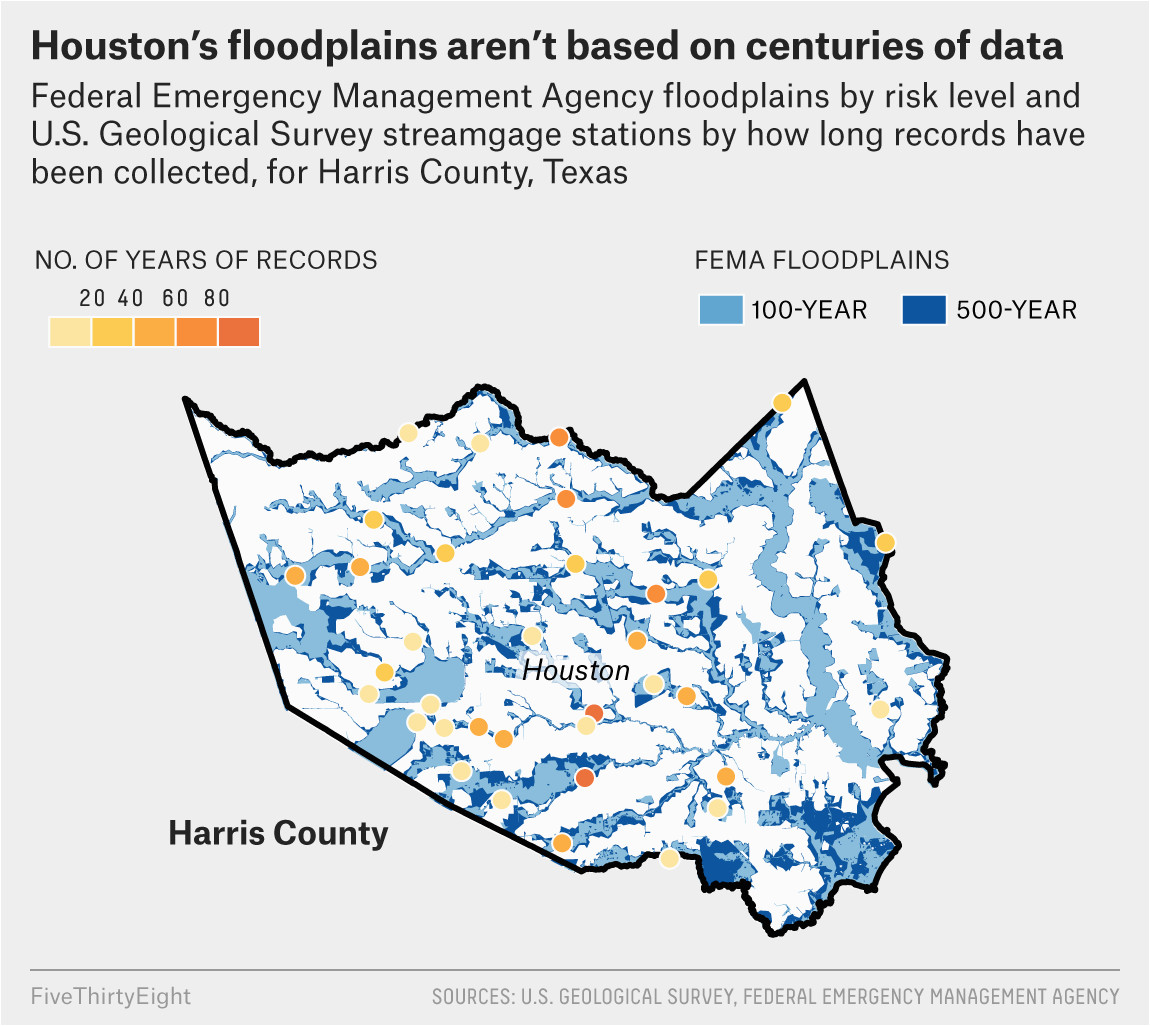

FIRMs are available to the public free of charge through the FEMA Flood MapService Center at.Get the cheapest flood insurance in Texas without sacrificing coverage. FEMA uses FIRMs to help determine what you should pay for flood insurance. People in Texas save on average 500 to 1,457+ on their annual flood premiums.Flood maps, known officially as Flood Insurance Rate Maps, show areas of high- and moderate- to low-flood risk.Ĭommunities use the maps to set minimum building requirements for coastal areas and floodplains lenders use them to determine flood insurance requirements.

0 kommentar(er)

0 kommentar(er)